-

Spreads

-

-

![Michael Rosen]()

-

CIO Insights are written by Angeles' CIO Michael Rosen

Michael has more than 35 years experience as an institutional portfolio manager, investment strategist, trader and academic.

RSS: CIO Blog | All Media

Spreads

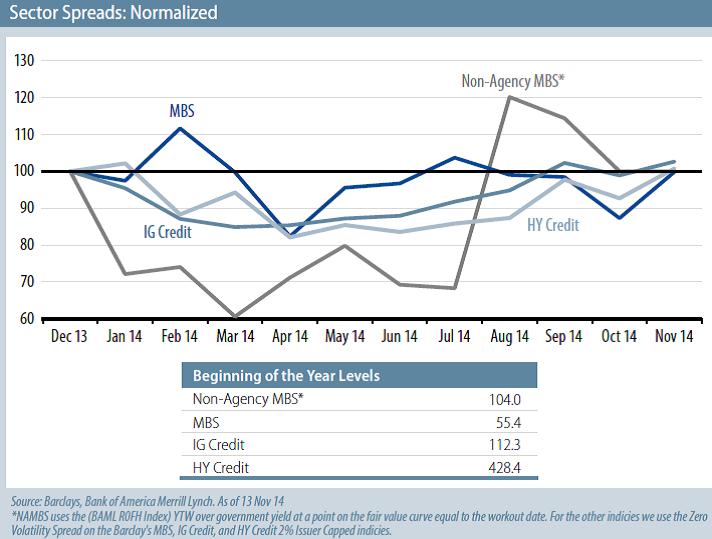

Published: 11-18-2014An interesting graphic from Ken Leech of Western Asset showing that spreads in Bondland this year are pretty much unchanged from the start of the year. This, despite the rally in US equities and solid economic growth. Thus, Ken concludes, spread products remain attractive.

I agree. There are numerous risks in fixed income, but that’s often the case. An economy that suddenly slumps will likely cause spread widening (although likely offset by rising bond prices). An unexpected economic boom could push bond prices lower (but spreads should hold true, if not tighten). An environment of moderate growth and low inflation should be favorable to spread products. And that’s my view.

Print this ArticleRelated Articles

-

![Beach Reading]() 20 Jun, 2023

20 Jun, 2023Beach Reading

Most of you know that I don't favor romance novels for reading on the beach (or anywhere else, for that matter, although ...

-

![US Manufacturing]() 4 Nov, 2014

4 Nov, 2014US Manufacturing

Wow. The good people at the Institute for Supply Management survey American manufacturers every month and ask, "how's ...

-

![From the Kentucky Coal Mines to the California Sun]() 14 Jan, 2020

14 Jan, 2020From the Kentucky Coal Mines to the California Sun

Rupp Arena is one of the iconic venues for college basketball in the country. It is named for Adolph Rupp, the legendary ...

-