-

Drop (in the bucket)

-

-

![Michael Rosen]()

-

CIO Insights are written by Angeles' CIO Michael Rosen

Michael has more than 35 years experience as an institutional portfolio manager, investment strategist, trader and academic.

RSS: CIO Blog | All Media

Drop (in the bucket)

Published: 09-15-2015Markets will fluctuate, as Pierpont Morgan caustically observed. And “fluctuate” means down as well as up. Perhaps I, too, am being caustically obvious, but I’ve long believed that a broad perspective on markets can often bring more clarity than myopic obsession.

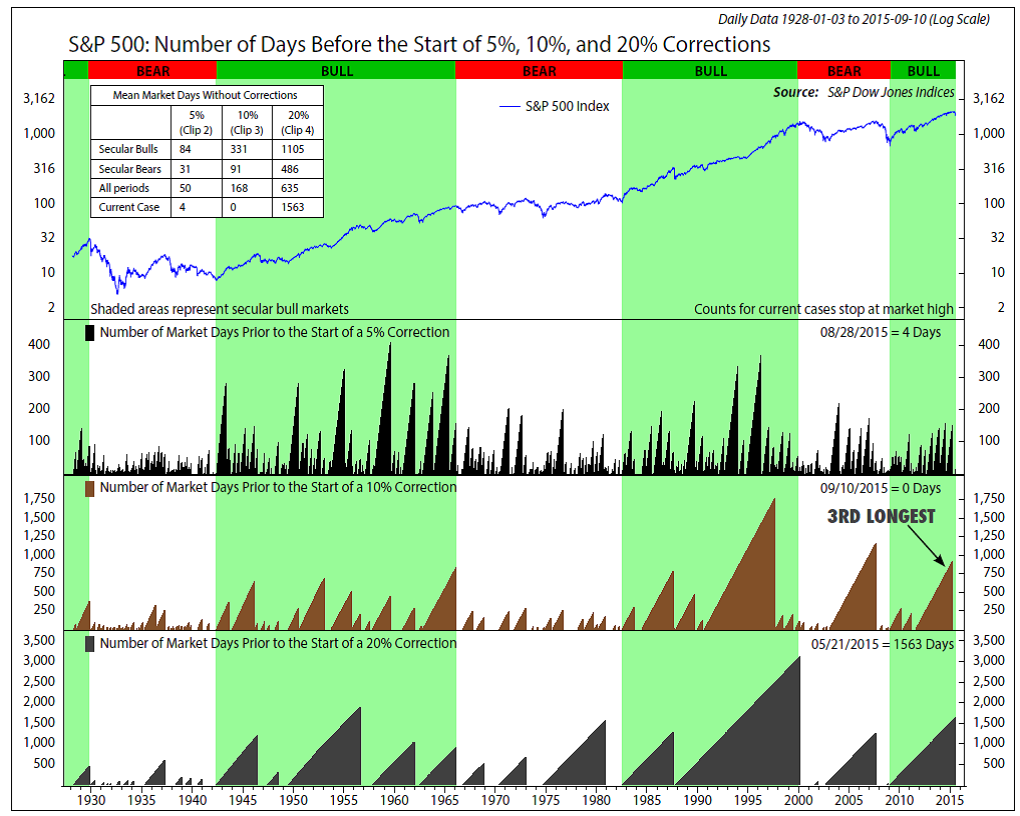

It was in 2011 that the S&P 500 Index last fell more than 10%, apparently beyond the memory of many investors who believed these corrections were relegated to ancient history, like buggy whips and handlebar moustaches. Last month the S&P dropped more than 6%, and between 21 May and 25 August of this year, declined 12.4%, ending the 3rd-longest spell (since 1928) without such a decline.

The graphic below (courtesy Ned Davis Research) plots the S&P 500 Index since 1928 (on semi-log scale) with the number of days between 5%, 10% and 20% declines. I’ll offer two observations: first, large corrections do seem to be occurring with a little less frequency than in the past, and secondly, the Index has risen from less than 5 in 1932 to around 2,000 today, declining frequently along the way. For long-term investors, the drop from 2,130 to 1,867 (May-August) is a drop in the bucket. It’s the move from 5 to 2,000 that really counts.

Print this ArticleRelated Articles

-

![Not Just A Game]() 10 Dec, 2020

10 Dec, 2020Not Just A Game

There are twenty amino acids in the human body. Amino acids are the chemical links that make up proteins. Proteins ...

-

![Europe Sputters, US Cruises]() 15 Dec, 2014

15 Dec, 2014Europe Sputters, US Cruises

Europe's unemployment rate is 11.5%. Europe is currently growing at less than 1%. A rule of thumb is that it takes ...

-

![La Justice?]() 7 Jun, 2016

7 Jun, 2016La Justice?

I'm not French, and I'm not a lawyer. So I am certainly not a French lawyer. These facts may be obvious, but I state ...

-